Login ins Mobile Banking

Dank Touch ID oder Face ID loggen Sie sich schnell und sicher ins Mobile Banking ein.

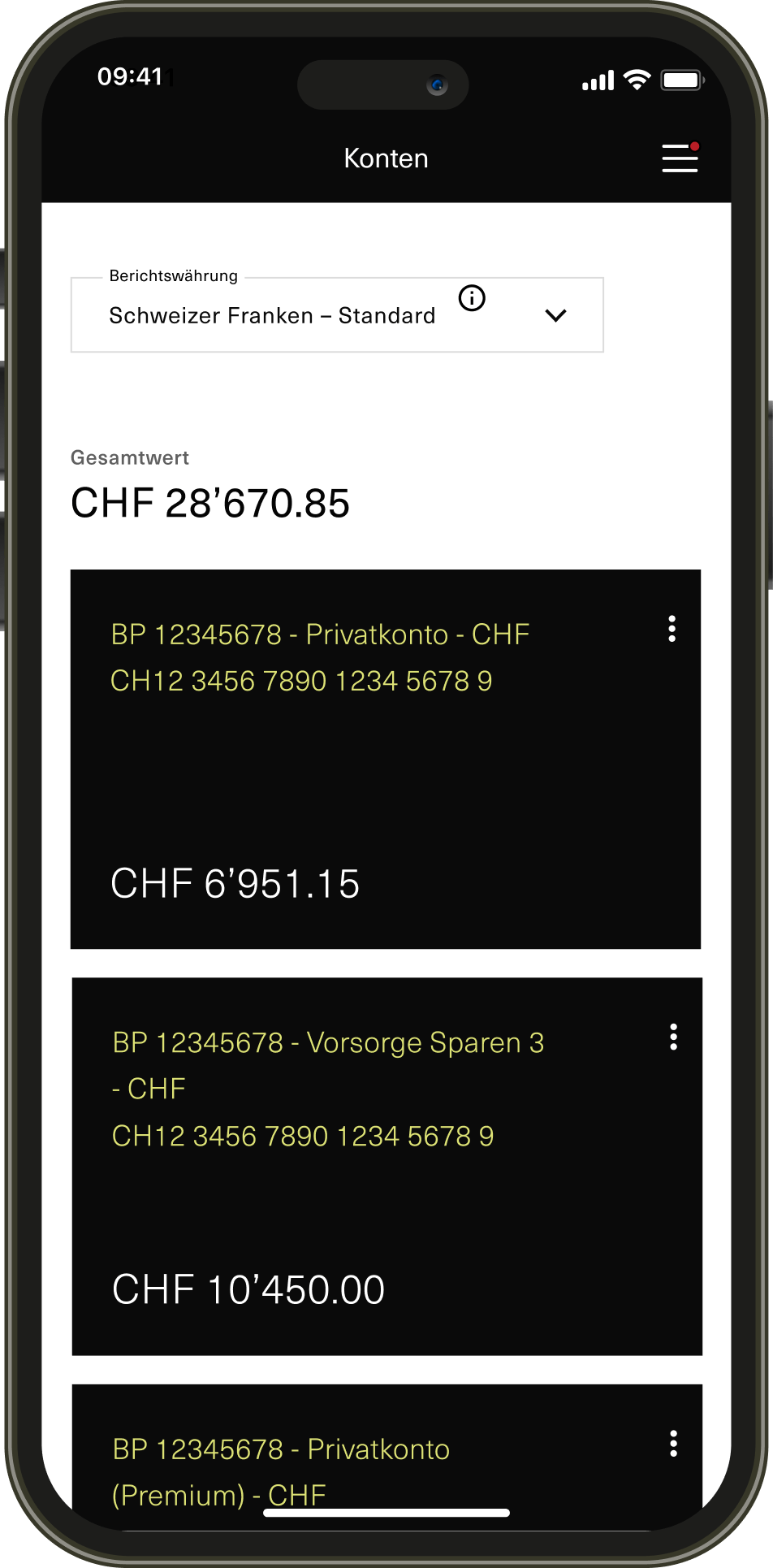

Kontostand auf einen Blick

Prüfen Sie jederzeit Ihre Kontosaldi und rufen Sie Ihre Buchungsdetails ab.

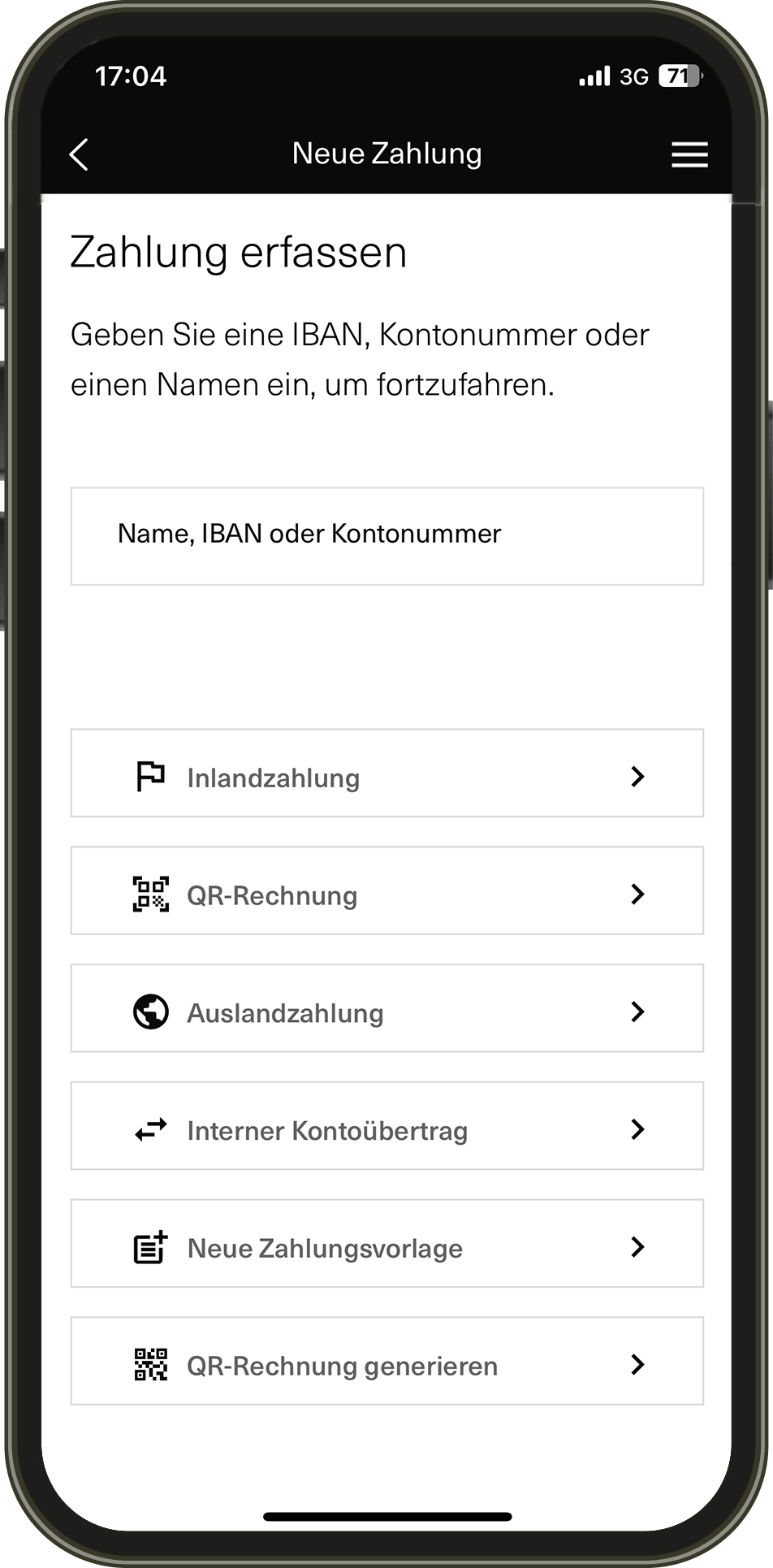

Zahlungsassistent

Ihre Zahlungen erfassen Sie dank dem Zahlungsassistenten noch schneller und einfacher.

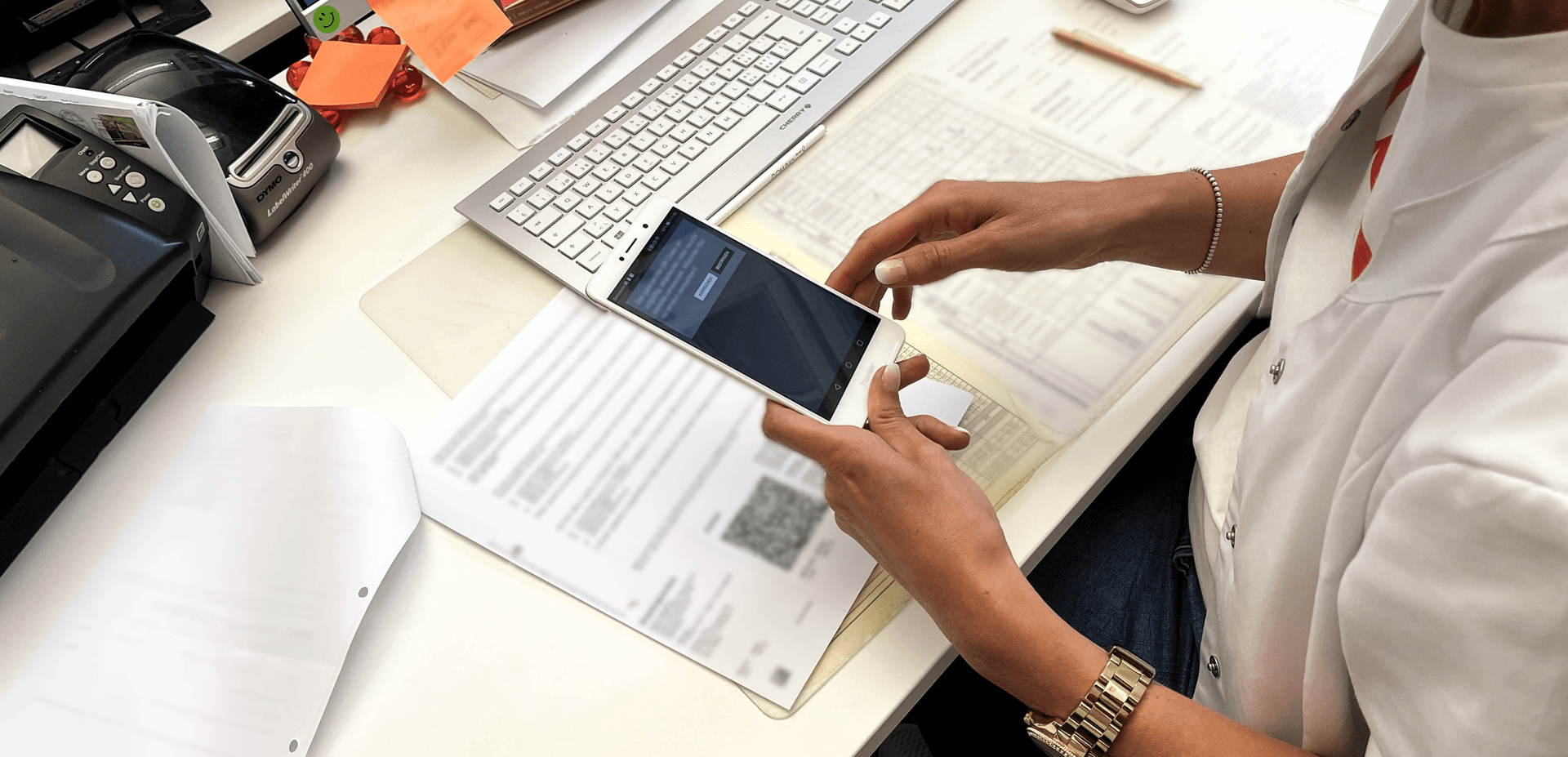

Zahlungen scannen

QR-Zahlscheine scannen Sie ganz einfach mit der Smartphone-Kamera und erledigen so Ihre Zahlungen mühelos.

eBill

Dank eBill erhalten Sie Ihre Rechnungen direkt in Ihr Mobile Banking und geben sie mit einem Klick frei.

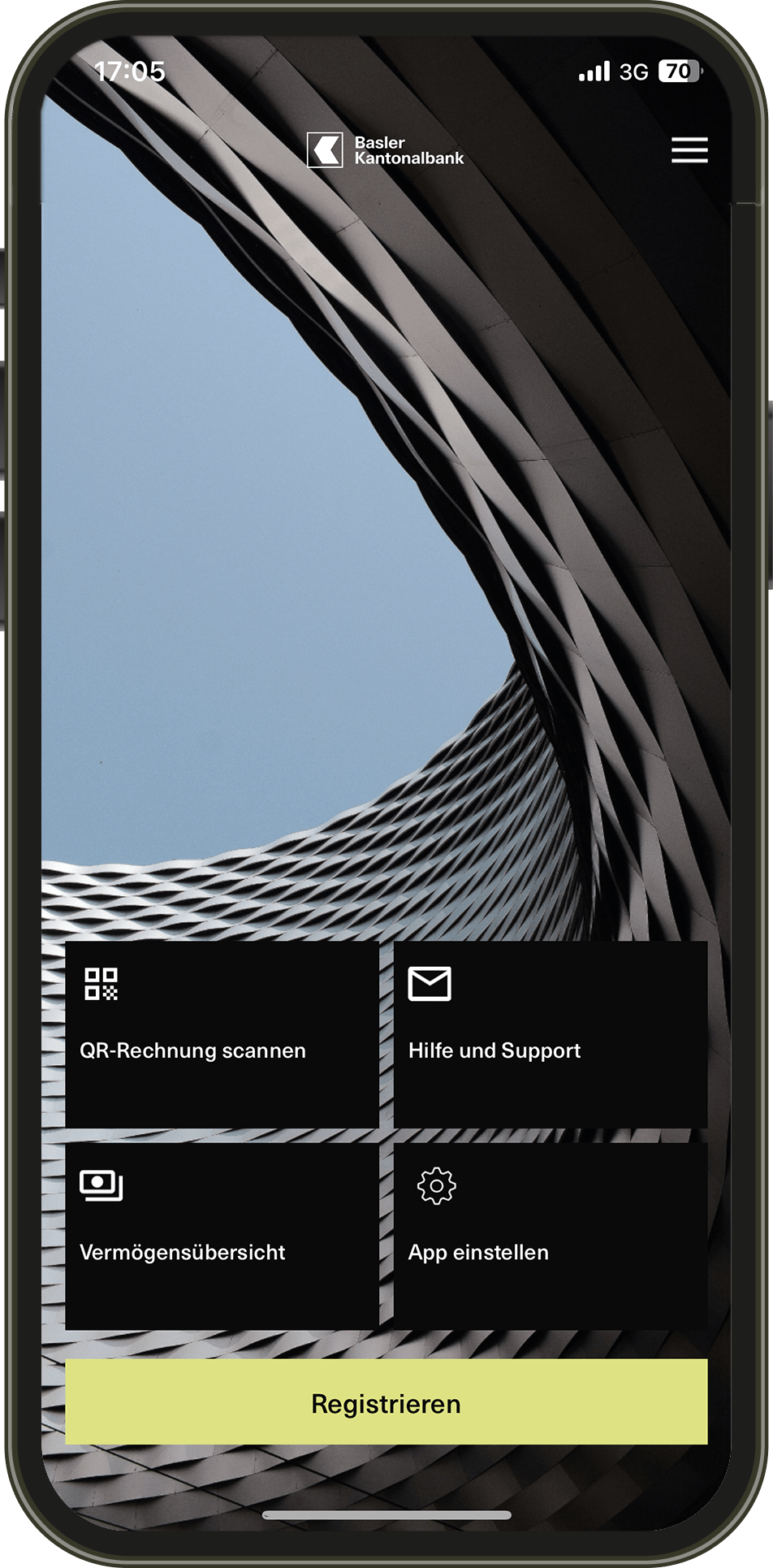

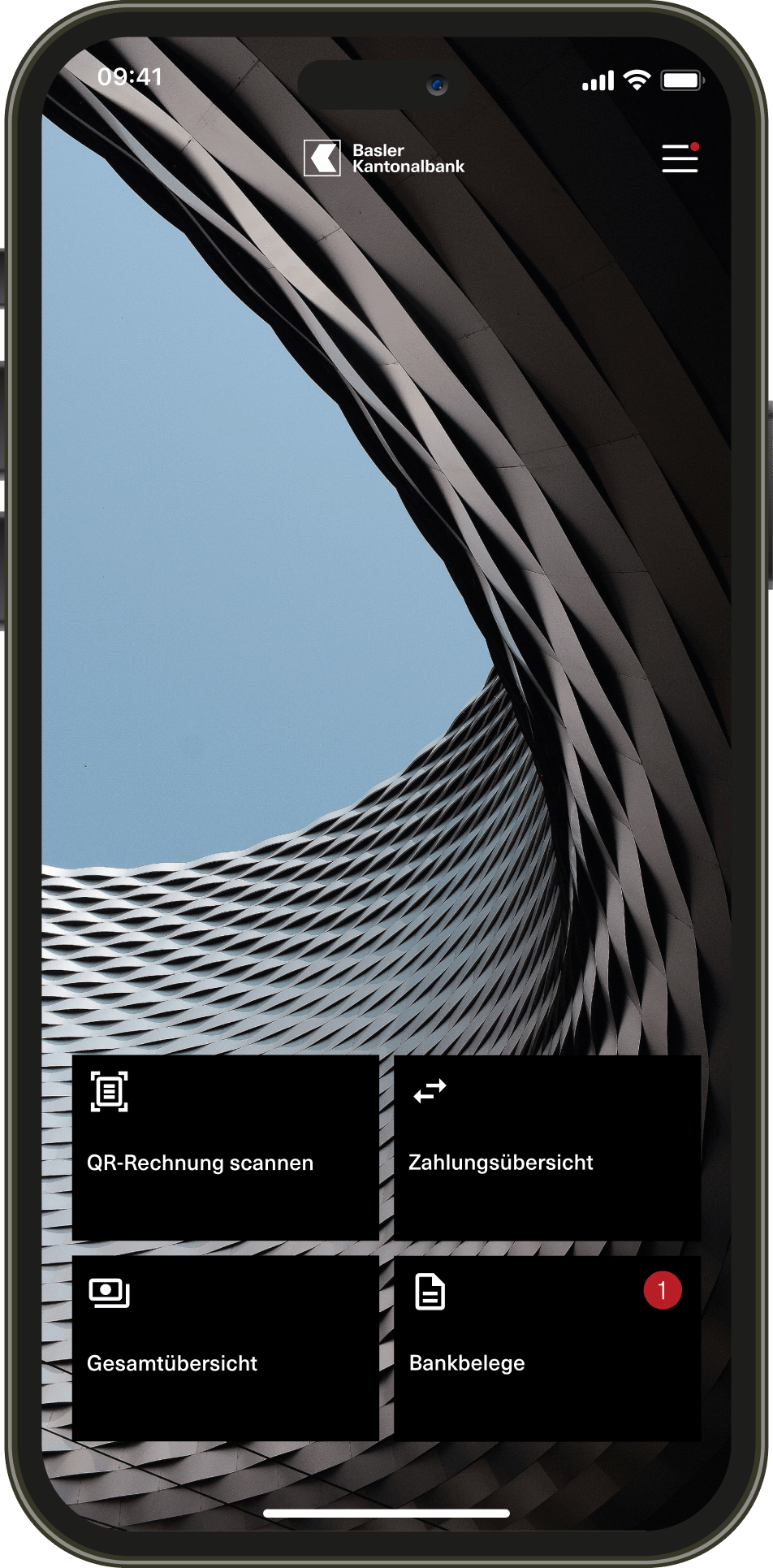

Übersicht einrichten

Platzieren Sie auf der Einstiegsseite die wichtigsten Funktionen nach Ihren Bedürfnissen.

Sicherheit

Sicherheit

Mobile Banking ist genauso sicher wie E-Banking. Bitte beachten Sie die folgenden Tipps und Verhaltensregeln:

- Halten Sie Ihr Passwort geheim und geben Sie es nie an Dritte weiter. Schreiben Sie es weder auf noch speichern Sie es auf Ihrem Smartphone. Das Gleiche gilt für Ihre Identifikationsnummer.

- Aktivieren Sie den Geräte-Sperrcode Ihres Smartphones.

- Schützen Sie die Eingabe der Identifikationsnummer und des PIN-Codes vor Blicken Dritter.

- Halten Sie das Betriebssystem Ihres Smartphones auf dem aktuellsten Stand.

- Beenden Sie Mobile Banking immer über die Logout-Funktion.

- Modifizieren Sie Ihr Smartphone nicht (kein «Jailbreak»/«Rooten»).

- Reagieren Sie nie auf Mails oder Telefonanrufe, in denen Sie aufgefordert werden, Informationen zu Ihrem E-Banking oder zu Ihrem Mobiltelefon bekannt zu geben.

- Weiterführende Informationen finden Sie auch beim NCSC, dem Nationalen Zentrum für Cybersicherheit des Bundes.

Für Ihre digitale Sicherheit engagieren wir uns kontinuierlich und arbeiten dazu mit der Hochschule Luzern im Rahmen von «eBanking – aber sicher!» zusammen.

Gut zu wissen

Gut zu wissen

- Damit Sie die App der BKB nutzen können, benötigen Sie einen gültigen E-Banking-Vertrag und ein Smartphone mit aktuellem Betriebssystem (mindestens iOS 15.x oder Android 11.x).

- Um sich erstmals in die App der BKB einzuloggen, benötigen Sie Ihr E-Banking-Login. Nach der Eingabe des Aktivierungscodes wird Ihr Smartphone fix an Ihren E-Banking-Vertrag gebunden. Dadurch erhöhen wir die Sicherheit. Denn so kann nur mit Ihrem Smartphone auf Ihr Konto zugegriffen werden.

- Wenn Sie die App der BKB erstmals verwenden, definieren Sie einen PIN-Code. Anschliessend loggen Sie sich entweder mit diesem Code oder mit Touch ID oder Face ID ein.